json-gui.site

Community

Saphire Cost

Only some people can afford to wear jewelry with real blue sapphire stones, as a top-quality blue sapphire can cost upto $10, to $50, a carat. Sapphire. Best Selling. Price, low to high; Price, high to low; Alphabetically, A-Z; Alphabetically, Z-A; Date, old to new; Best Selling; Date, new to old. The price starts from $1,/carat for good quality gems up to $10k+/carat for untreated sapphires of the highest gem-quality. Pink sapphires are becoming. Princess Cut Blue Sapphire. Write a Review. There are no contributions yet. Leave a Review. How would you rate this product? *. Perfect Good Average Mediocre. Certain sapphire colors are important in Ayurvedic (or Hindu) astrology. In this practice, blue sapphire, called Neelam, is a Saturn star stone while yellow. Clarity Intensity Treatment Origin Price. Type. Clear filters. Ruby. Sapphire. Emerald. View 1, gemstones. Shape. Clear filters. RoundRound. How Much Are Sapphires Worth? Depending on the gemstone you choose, sapphire price can cost $25 per carat to more than $11, per carat. Price Guide for Top Gem Quality Natural Ceylon White Sapphire Loose Gemstones - json-gui.site Sapphire Facts · The most expensive blue sapphire ever sold is the Blue Bell of Asia. In , it sold for over $17 million. · Some sapphires can feature more. Only some people can afford to wear jewelry with real blue sapphire stones, as a top-quality blue sapphire can cost upto $10, to $50, a carat. Sapphire. Best Selling. Price, low to high; Price, high to low; Alphabetically, A-Z; Alphabetically, Z-A; Date, old to new; Best Selling; Date, new to old. The price starts from $1,/carat for good quality gems up to $10k+/carat for untreated sapphires of the highest gem-quality. Pink sapphires are becoming. Princess Cut Blue Sapphire. Write a Review. There are no contributions yet. Leave a Review. How would you rate this product? *. Perfect Good Average Mediocre. Certain sapphire colors are important in Ayurvedic (or Hindu) astrology. In this practice, blue sapphire, called Neelam, is a Saturn star stone while yellow. Clarity Intensity Treatment Origin Price. Type. Clear filters. Ruby. Sapphire. Emerald. View 1, gemstones. Shape. Clear filters. RoundRound. How Much Are Sapphires Worth? Depending on the gemstone you choose, sapphire price can cost $25 per carat to more than $11, per carat. Price Guide for Top Gem Quality Natural Ceylon White Sapphire Loose Gemstones - json-gui.site Sapphire Facts · The most expensive blue sapphire ever sold is the Blue Bell of Asia. In , it sold for over $17 million. · Some sapphires can feature more.

The durability of this gem-quality member of the corundum family makes it an exceptional gemstone. The rare, blue Kashmir sapphire commands the highest prices. Sapphire Gemstone 4mm ( ct). Gemstone Price Match Guarantee. Compare; Add to Wishlist; Drop A Hint. Gemstone DETAILS. View Certificate. This Blue Sapphire. Natural blue sapphire, all viewable in ° HD. Rotate every sapphire up Price. Sort By. Best Match. △. Top. Retail price: $ Add to Cart. Padparadscha Sapphire Dreamscape™ Cut (Sold). Padparadscha Sapphire gemstone. carats x mm. Item# PADN Retail. Many star sapphires in the range of carats often sell for $ USD per carat. Larger stones can demand much higher prices, and star treatment that is not. This Spruce Sapphire is a deep blue-green that many mistake for Name Your Price. Your chance to name a price! Give us your best offer. You'll get the. Price range. GO. Color. Orange. Shape. Oval. Shape Sapphire stones; Orange Sapphires. Cookie Settings. We use cookies to enhance your browsing experience. Neelam Stone Price. Neelam Stone price stems from its rarity and popularity as a jewelry gemstone. In addition, being astrologically important, blue sapphire. Sapphire · STOCK UNLIMITED · SHOP BY · PRICE · Under $ · $ - $ · $ - $ · $ - $ · $ - $ · $ - $ · $ - $ · $ - $ Sort by price: high to low. Teal Montana Sapphire – Round Carats. $29, Add to cart · White Montana. What does a 1 carat sapphire cost? A top quality 1 to 2 carat stone can be offered in retail stores at prices between 1, - 2, Dollars per carat. Quality 2. Cost of your sapphire engagement ring depends on a few factors: the size & color of your stone, accent stones or diamonds, metal and the setting. While the cost. Featured FirstNew Items FirstPrice: Low to HighLowest To HighestPrice Sapphire Company Reviews on Verified Reviews | The Natural Sapphire. Montana Sapphire. Apply Selection. Clear Filter. Filter By. More Filters. Price. $ -. $ Carat Weight. cts. -. cts. Color. Select Color. Price match guarantee · 30 Day free Returns · Lifetime Guarantee · Summer sale Emerald. Sapphire. Garnet. Amethyst. sapphire instead for my engagement ring (because of their durability vs emeralds). My question is, how much would a GOOD sapphire cost usually? Blue sapphires are commonly heat treated to improve color and clarity, but treated stones do not command the prices that a fine, vivid blue natural color gem. Sort By. Featured, Price: Low to High, Price: High to Low, Alphabetically: A-Z, Alphabetically: Z-A, Oldest, Newest, Best Selling. Quick Buy. Add to Wishlist. Blue sapphires with extremely high clarity are rare, and very valuable. Price can drop if the inclusions threaten the stone's durability. Kashmir sapphires. Know about the value of Sapphire in the USA market. Market Value Charts by Gemval - choose Sapphire from the list of gemstones. Gemstone Charts!

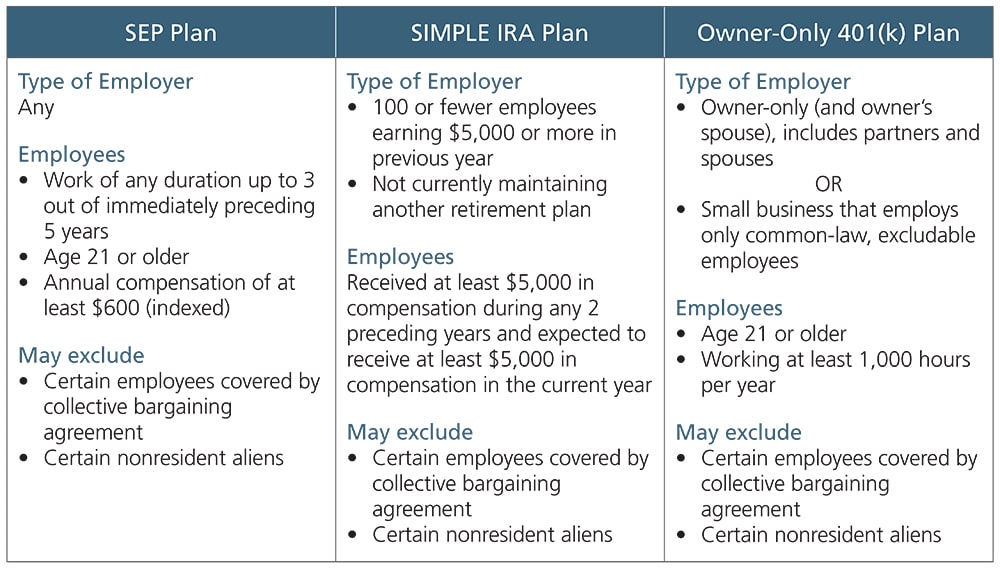

Sep Ira For Single Member Llc

A SEP IRA serves as a cost-effective option for small businesses who want to contribute to their retirement savings as well as those of their employees. Annual contributions can be made into a SEP IRA up to 25% of W-2 income. Sole proprietorship, partnership or an LLC taxed as a sole proprietorship. For those. SEP plans (that are not SARSEPs) only allow employer contributions. For a self-employed individual, contributions are limited to 25% of your net earnings from. Because of the high contribution limits, highly compensated owners of single-person firms can also profit from SEP IRAs. A SEP IRA may be a wise choice if. You only need to enter Simplified Employee Pension (SEP) IRA contributions made through self-employment work. If your employer made a SEP IRA contribution. SEP IRAs and SIMPLE IRAs are generally good starting points to consider for small businesses, but (k) plans may offer greater choices in plan design. The. No plan tax filings with IRS. Each employee must open an individual SEP IRA account. As an example, for a sole proprietor April 15 would typically be the. A SEP IRA is an IRA that you set up in your name and your employer makes all the contributions on your behalf. You can establish this type of IRA after. Have any eligible employees for whom. IRAs have not been established. 3. Use the services of leased employees. (described in section (n)). 4. Are a member of. A SEP IRA serves as a cost-effective option for small businesses who want to contribute to their retirement savings as well as those of their employees. Annual contributions can be made into a SEP IRA up to 25% of W-2 income. Sole proprietorship, partnership or an LLC taxed as a sole proprietorship. For those. SEP plans (that are not SARSEPs) only allow employer contributions. For a self-employed individual, contributions are limited to 25% of your net earnings from. Because of the high contribution limits, highly compensated owners of single-person firms can also profit from SEP IRAs. A SEP IRA may be a wise choice if. You only need to enter Simplified Employee Pension (SEP) IRA contributions made through self-employment work. If your employer made a SEP IRA contribution. SEP IRAs and SIMPLE IRAs are generally good starting points to consider for small businesses, but (k) plans may offer greater choices in plan design. The. No plan tax filings with IRS. Each employee must open an individual SEP IRA account. As an example, for a sole proprietor April 15 would typically be the. A SEP IRA is an IRA that you set up in your name and your employer makes all the contributions on your behalf. You can establish this type of IRA after. Have any eligible employees for whom. IRAs have not been established. 3. Use the services of leased employees. (described in section (n)). 4. Are a member of.

A SEP IRA plan can be established by any type of business, including a sole proprietorship, partnership, limited liability company (LLC) or corporation (S or C);. SEP IRAs are an easy, low-cost way for small business owners, including sole proprietors, to save for retirement. A single investment provides a fund. Simple ira for single member llc Web1. Feb. · The maximum contribution for a small business owner to a (k) for is $61, ($67, if you're Contributions to a SEP IRA are generally tax-deductible to the business, as are SEP IRA plan expenses (subject to certain limits). Like traditional IRAs and A SEP-IRA is for anyone who is self-employed, has employees, or earns free-lance income while holding a job. Learn how to set up your SEP-IRA today. The information provided below is very complicated. Sit recommends consulting a tax professional. As a sole proprietor, you must calculate your net income. SEP-IRA vs. solo k for single member LLC taxed as an S-corp · Employee Salary Deferral - max is $20, plus another $6, if. For a business owner with no employees, it doesn't really make a difference whether you pay into the SEP IRA from your company's account or from your personal. The information provided below is very complicated. Sit recommends consulting a tax professional. As a sole proprietor, you must calculate your net income. SEP-IRA vs. solo k for single member LLC taxed as an S-corp · Employee Salary Deferral - max is $20, plus another $6, if. In , employer contribution limits for each eligible employee are limited to the lesser of $66, or 25% of that person's compensation. For example, if. TAXPAYER is a Tennessee limited liability company whose single member is the [NAME], a simplified employee pension plan (the “SEP IRA”). The Taxpayer was formed. Deductions for contributions to a SEP IRA, Solo k, SIMPLE IRA, or Sole Proprietorships, Qualified Joint Ventures, and Single-Member LLCs (also. For a business owner with no employees, it doesn't really make a difference whether you pay into the SEP IRA from your company's account or from your personal. Sole proprietorships, S and C corporations, partnerships and LLCs qualify. SEP IRA contribution limits. The SEP IRA contribution limit is $66, and the. The simple answer is yes and no, you may contribute to a Solo (k) and SEP IRA in the same year. It all depends on the forms you use. These individual retirement accounts (IRA) are tailored for employees' retirement funds while employers reap a SEP IRA plan's tax deductions compared to other. SEP IRA, even if there is only one employee. Learn the benefits and Invest in both traditional and alternative assets with a single custodian – ready to go. No, only an employer can maintain and contribute to a SEP plan for its employees. For retirement plan purposes, each partner or member of an LLC taxed as a.

What Is Capital In Finance

Capital is a term for cash or financial assets held by a business or an individual. It can be a total sum of different assets, such as bank deposits, stocks. At Capital Group, home of American Funds, we've been helping people find investing success since financial futures. That's because we've stayed true to. Capital is anything that increases one's ability to generate value. It can be used to increase value across a wide range of categories, such as financial. a multi-disciplinary, holistic financial planning firm with core beliefs in fee-based financial planning, maximum protection, a foundation in permanent. Financial capital is any economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their products or. Traditional asset-based lending, specialized junior, and senior secured financing to help you through your business cycles. Financial capital is the monetary assets required for a business to provide goods and services. Economic capital is commonly calculated through risk. Financial capital, which is also referred to as investment capital, is the financial assets or economic resources a business or organization needs to provide. Capital is any type of asset that you can use to generate future value, including cash and tangible and intangible assets. Capital is a term for cash or financial assets held by a business or an individual. It can be a total sum of different assets, such as bank deposits, stocks. At Capital Group, home of American Funds, we've been helping people find investing success since financial futures. That's because we've stayed true to. Capital is anything that increases one's ability to generate value. It can be used to increase value across a wide range of categories, such as financial. a multi-disciplinary, holistic financial planning firm with core beliefs in fee-based financial planning, maximum protection, a foundation in permanent. Financial capital is any economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their products or. Traditional asset-based lending, specialized junior, and senior secured financing to help you through your business cycles. Financial capital is the monetary assets required for a business to provide goods and services. Economic capital is commonly calculated through risk. Financial capital, which is also referred to as investment capital, is the financial assets or economic resources a business or organization needs to provide. Capital is any type of asset that you can use to generate future value, including cash and tangible and intangible assets.

The total of both capital and working capital is the amount required to operate your business "Capital," in investment terms, is money to finance the purchase. Summary · The goal of the capital structure decision is to determine the financial leverage that maximizes the value of the company (or minimizes the weighted. Capital Structure is the combination of equity and debt that is put into use by a company in order to finance the overall operations of the company. Capital is a financial asset that usually comes with a cost. Here we discuss the four main types of capital: debt, equity, working, and trading. Capital can be any financial asset that is used. The money made from its current activities is shown as capital on a company's balance sheet. Some examples are. Capital is anything that increases one's ability to generate value. It can be used to increase value across a wide range of categories, such as financial. In serving the university's needs, the staff of Capital Markets Finance is dedicated to providing efficient service with the highest standards of excellence. Capital is the money used to build, run, or grow a business. It can also refer to the net worth (or book value) of a business. Capital markets are financial markets that bring buyers and sellers together to trade stocks, bonds, currencies, and other financial assets. Working capital finance investments (WCFI) are confirmed short-term (not exceeding one year) obligations, to pay a specified amount owed by one party (the. Capital is the collective term for resources a business uses to generate to generate profit. Capital can be physical assets like buildings and machinery. Trading capital is only relevant to certain financial services companies, for example brokerages. It refers to the amount of money allocated to each trader. Not to be confused with Financial capital or Economic capital. In economics, capital goods or capital are "those durable produced goods that are in turn used as. Tell us who you are to help personalize your experience. · Financial Professional · RIA · Individual Investor · Private Client · Retirement Plan Investor. Capital is the result of discovering and unleashing potential energy from the trillions of bricks that the poor have accumulated in their buildings. Capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. A firm's capital structure. What Are Capital Assets? Capital Assets are moveable and fixed items owned by Columbia University and can be any of the following items: Buildings; Building. Capital is the lifeblood of any businesses, but especially small businesses. Without adequate financing, through microloans, commercial lending. Learn how banking with Capital One can help you meet your financial goals. Capital is the value of the investment in the business by the owner(s). It is that part of the business that belongs to the owner; hence it is often described.

Fast And Easy Business Loans

Apply for quick business loans in minutes for an instant decision. Once approved, you can get funds by the next business day. You don't need perfect credit. You can apply for a Business Advantage Auto Loan online · If you use Small Business Online Banking, you can apply for an unsecured business loan or unsecured. A fast business loan is a funding solution that's processed and available in your bank account within 24 to 48 hours – or sooner. At Rapid Finance, we specialize in fast, simple, and trusted business financing. Our financing options enable small businesses to access working capital when. A secured business Quick Loan uses your business assets as collateral and offers loan amounts up to $, and terms from months. Apply. If you have trouble getting a traditional business loan, you should look into SBA-guaranteed loans. When a bank thinks your business is too risky to lend money. A secured business Quick Loan uses your business assets as collateral and offers loan amounts up to $, and terms from months. Apply. With a simpler application, faster turnaround, and flexible approval requirements, Greenbox Capital can fund more businesses with low credit in as little as one. Quick business loans are for organisations that need money in a hurry. Applications are usually approved in seconds and completed in the shortest possible time. Apply for quick business loans in minutes for an instant decision. Once approved, you can get funds by the next business day. You don't need perfect credit. You can apply for a Business Advantage Auto Loan online · If you use Small Business Online Banking, you can apply for an unsecured business loan or unsecured. A fast business loan is a funding solution that's processed and available in your bank account within 24 to 48 hours – or sooner. At Rapid Finance, we specialize in fast, simple, and trusted business financing. Our financing options enable small businesses to access working capital when. A secured business Quick Loan uses your business assets as collateral and offers loan amounts up to $, and terms from months. Apply. If you have trouble getting a traditional business loan, you should look into SBA-guaranteed loans. When a bank thinks your business is too risky to lend money. A secured business Quick Loan uses your business assets as collateral and offers loan amounts up to $, and terms from months. Apply. With a simpler application, faster turnaround, and flexible approval requirements, Greenbox Capital can fund more businesses with low credit in as little as one. Quick business loans are for organisations that need money in a hurry. Applications are usually approved in seconds and completed in the shortest possible time.

Unsecured Business Loans - If you're unable to put up collateral, you may not qualify for traditional, fast business funding. Unsecured loans offer you. In this guide, we'll break down the best fast business loan options as well as everything you need to know about qualification and approval. Small businesses frequently come across opportunities where they need to act quickly. Bridge loans are instant small business loans designed with a speedy. A fast business loan is a funding solution that's processed and available in your bank account within 24 to 48 hours – or sooner. Ensure your business gets fast, easy, and affordable financing. We connect small business owners with SBA Express loans and small business loan alternatives. Ensure your business gets fast, easy, and affordable financing. We connect small business owners with SBA Express loans and small business loan alternatives. Quick Capital Funding makes business financing simple. We offer multiple financing & loan options to fit the exact needs of your company. Faster, simpler, more flexible. Easy business loans are an ideal funding choice for small business owners who want a loan quickly and without all the fuss. Need a fast business loan? Apply now & get instant approval for up to $ Get a quote in 5 mins and funded in 1 hour. Call Simple Business Loan · Apply for a specific loan amount up to $50, · Choose the term of your loan (up to 60 months). ; Small business commercial vehicle and. Minute application process and fast funding. $15 Billion delivered to US businesses. A+ Rating with the Better Business Bureau. Online lenders like National Funding guarantee fast and easy access to small business loans once approved. In general, alternative lenders have quicker loan. A fast business loan provides funds within 24 to 48 hours with minimal documentation needed. With fast business loans, you can access the funds within the day. AdvancePoint Capital simplifies the process of obtaining a business loan in Florida by offering a fast and straightforward application process for business. These short-term loans are the fastest business loans that stabilize your cash flow and meet immediate business needs. Quick business loans like short term small business loans are the best fast business loans if you acquire from online lenders. These term loans offer a lump sum. Wells Fargo has something for any small business, including business credit cards, loans, and lines of credit fast and easy! We've made our application process as quick and easy as possible. Apply in minutes and you could receive a loan for your business on the same day. We'll always. Small Business Loans with Rapid Finance · Trusted by over 30 thousand businesses around the country · Real humans, real business advisors, real success stories. Do you qualify? · Must have atleast 12 months in business · Your business must generate $50, or more in annual sales · You must own at least 20% of the.

Turbotax Through Irs

You can pay your federal taxes directly from your checking or savings account with direct debit. There's no fee for direct debit. Even though the deadline has passed, you can file your taxes online in a few simple steps. Our online income tax software uses the IRS tax code. Prepare and file your federal income tax return online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. Learn more about how to use the TurboTax mobile app, enter IRS tax forms in How do I clear and start over in TurboTax Online? - TurboTax Support. Over 10 million returns filed, all for $0 "If you're looking for free online tax software, Cash App Taxes is the only service offering truly free federal and. If you are referring to the free version of Turbo Tax, there probably isn't much difference. The IRS version is actually a list of online. Below are IRS Free File tax preparation and filing services from trusted partners for you to explore. For best results, use the IRS Free File "Find Your Trusted. PAYcom/SpecialOffers/TurboTax The integrated e-file and e-pay debit/credit card option is available through a number of tax preparation software products. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate. You can pay your federal taxes directly from your checking or savings account with direct debit. There's no fee for direct debit. Even though the deadline has passed, you can file your taxes online in a few simple steps. Our online income tax software uses the IRS tax code. Prepare and file your federal income tax return online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. Learn more about how to use the TurboTax mobile app, enter IRS tax forms in How do I clear and start over in TurboTax Online? - TurboTax Support. Over 10 million returns filed, all for $0 "If you're looking for free online tax software, Cash App Taxes is the only service offering truly free federal and. If you are referring to the free version of Turbo Tax, there probably isn't much difference. The IRS version is actually a list of online. Below are IRS Free File tax preparation and filing services from trusted partners for you to explore. For best results, use the IRS Free File "Find Your Trusted. PAYcom/SpecialOffers/TurboTax The integrated e-file and e-pay debit/credit card option is available through a number of tax preparation software products. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate.

Sign In/Account Recovery. If you have filed with IRS Free File Program delivered by TurboTax. (formerly TurboTax Free File Program, or TurboTax Freedom Edition). by TurboTax• 79• Updated 7 months ago The IRS begins accepting e-filed returns on January 29, You can file your federal return when you have all of. Funds are usually withdrawn on the payment date you specify in TurboTax, assuming your e-filed return has already been accepted (received) by the IRS. You may qualify to file your federal and state return with FREE tax filing software if you made $79, or less in If you don't qualify for free. Why use TurboTax Free Edition? · File your federal & state taxes for free · Ideal for. W-2 income · Maximize tax credits for dependents · Get the green. IRS when you file taxes in Basic Info. Progress Indicator. Basic Info; Income; Deductions; Credits; Results. Personal Info. Tax Year. , Date of. Best Tax Software: Freelancers, Pay Your Quarterly Taxes by September 16 · TurboTax · TurboTax · TurboTax · H&R Block · FreeTaxUSA · Cash App Taxes · TaxSlayer · TaxAct. The fastest way to file taxes is online. IRS's e-file system enabled million taxpayers to file their returns electronically last tax year. Intuit, the maker of TurboTax, has engaged in a multi-million dollar lobbying campaign against the Internal Revenue Service (IRS) creating its own online system. Estimate your tax refund or how much you may owe the IRS with TaxCaster tax calculator. Feel confident with our free tax calculator that's up to date on the. Free File: Guided Tax Software. Do your taxes online for free with an IRS Free File trusted partner. Individuals can call () , Monday through Friday, a.m. - p.m. local time. You must sign in to vote. Found what you need? Start my taxes. While they may be available from the IRS on a given date, we need a few days to make the forms available for use in TurboTax. If the e-file date says. The fastest way to file taxes is online. IRS's e-file system enabled million taxpayers to file their returns electronically last tax year. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. TurboTax Free through Premier/Home & Business will handle the most common IRS tax forms for individual (personal) tax json-gui.sitee few taxpayers need the. Funds are usually withdrawn on the payment date you specify in TurboTax, assuming your e-filed return has already been accepted (received) by the IRS. As fast as e-filing. Tax refund is available the same day the IRS issues the automated payment. How pay-by-refund works. Once the tax return is prepared and a. A government-run tax preparation and filing service has some wondering if people will leave H&R Block and TurboTax and let the IRS do their taxes instead. Use this tool to research tax return preparers near you or to determine the type of credentials or qualifications held by a specific tax professional.

1 2 3 4